Amaron Commercial Real Estate Fund

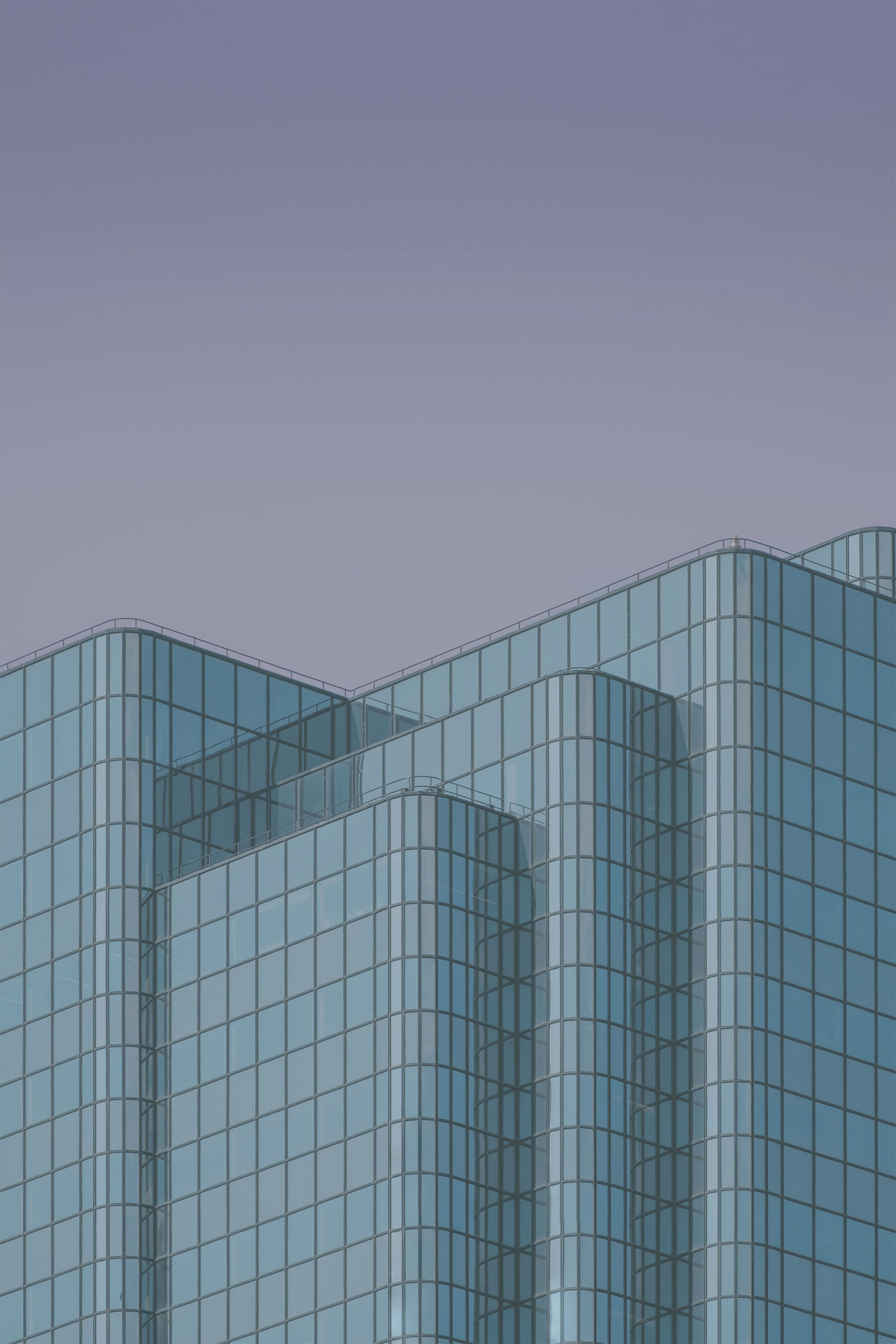

The Amaron Commercial Real Estate Fund is a Swedish alternative investment fund, AIF. The fund will build the core of its investments within the commercial real estate sector: office space, industrial properties, logistics properties, and real estate for public use. Typically, the assets will range between SEK 40-200 Mn. The fund may also pursue opportunities and development opportunities in the residential sector. The ultimate fund value is expected to be SEK 4-6 Bn, and the indicative duration of this closed-end fund is expected to be ten years.

The Greater Copenhagen region, one of the most attractive regions in the Nordics, has been carefully selected based on its underlying economic fundamentals and the team’s local knowledge, network, and experience.

Fund Profile

In the heart of the Greater Copenhagen Region - a dynamic transnational market of over 4,4 million consumers

The link between the 28 million consumers in Scandinavia and over 100 million in Northern Europe

Green buildings, i.e., certified properties, or the right fundamentals for a certification

Commercial properties such as light industrial, logistics, office, and strategic projects

Cash-flow driven portfolio with inflation-hedged index-linked contracts

Locations with well-functioning communications and proximity to city centres and service facilities

Typical individual property size SEK 75-150 million

Long-term management approach with a focus on cost-efficient and value-enhancing property management

Fund objectives

Attractive risk-adjusted returns combined with long-term capital growth.

Coupon

An annual coupon of minimum 4 per cent paid quarterly, portfolio development realized at exit

Return on investment

Generate an average return on investment of 10-15 per cent annually (including coupon)

Leverage

The long-term leverage use is set to 50 per cent LTV

Asset Allocation

Focus on commercial properties such as office, industrial, logistic, and public residential properties and projects

ESG

Sustainability requirements apply to the fund as well as to the property management and technical maintenance

FUND TERM SHEET

-

2022

-

SEK

-

0.85% of AUM

-

20%, hurdle rate 5%, no catch-up

-

4%, paid quarterly

-

10-15% annually

-

Indicative 8-10 years

-

Quarterly

-

Sweden

-

Limited company (AB)

-

Amaron Fund Management AB

-

FI, Sweden

-

PWC

-

GYB Depositary Services AB

-

Andulf Advokat AB

-

SEK 4-6 billion